If you have insurance however can not confirm it when you obtain drawn over or at the scene of a crash, you are guilty of an "administrative infraction," comparable to a seat-belt ticket. Your citation will certainly not be disregarded also if you can supply the court with evidence of valid insurance policy for the day of the citation. cheaper car.

Driving without automobile insurance coverage at all is a lot a lot more significant, as well as the charges are a lot more severe. In enhancement to the lawful repercussions, you can additionally anticipate your cars and truck insurance coverage premium to rise. A single sentence for driving without insurance elevates yearly costs by an average of 36%, or $647, in California (low-cost auto insurance).

Driving uninsured can make it hard to be made up for problems if you are not at mistake and can have resilient and life-altering repercussions if you are at mistake. If the mishap is your mistake, you'll have to pay for all the damages out of your own pocket. In addition to the legal repercussions for driving without insurance, you could quickly be responsible for 10s of hundreds of dollars or more in damage to your vehicle, the other vehicle driver's repair work and also medical facility bills, as well as your very own healthcare.

cheaper auto insurance insurance cheaper car cheap auto insurance

cheaper auto insurance insurance cheaper car cheap auto insurance

You can deal with installing financial debt and even personal bankruptcy, especially if the various other vehicle driver doesn't carry uninsured driver insurance coverage or injury defense. car. Also if the mishap is not your fault, driving without insurance coverage leaves you at risk to costly medical facility as well as fixing costs. California is an at-fault state. In at-fault states, the other motorist is generally responsible for damage to your cars and truck and also any clinical therapy you may needassuming the other driver is located totally at-fault.

perks risks risks affordable auto insurance

perks risks risks affordable auto insurance

insured car auto insurance car credit score

Driving without insurance doesn't negate the other motorist's fault totally, but you're almost certainly going to be penalized as well as not able to recoup everything you would certainly be entitled to if you had insurance policy. You can obtain auto insurance coverage in California, even if you are Unless you're a newly accredited vehicle driver, having a history of driving without insurance policy or lapses in coverage is a danger to insurance companies.

Getting My Cheap California Car Insurance - Auto Quotes In Ca(2022) To Work

USAA, State Ranch, Nationwide, as well as Geico have a tendency to have the least expensive rates for vehicle drivers that intend to restore insurance coverage. It's not prohibited to drive another person's vehicle if you do not have insurance, yet non-owner automobile insurance coverage can secure you if you do not have a cars and truck yet still drive on a regular basis (cheap).

In The golden state, vehicle drivers with just two speeding tickets pay an average of 97% even more on their annual vehicle insurance coverage premiums, for instance. Depending on your driving record and the severity of your infractions, you can pay also extra. Still, even though rates might be greater, at the very least you can drive legitimately as well as prevent even more penalties - dui.

The repercussions of driving without insurance are inevitably much more expensive than acquiring minimal vehicle insurance policy coverage - car. No issue what your one-of-a-kind demands are, the best method to obtain precise quotes as well as the best prices is to contrast store. cheap auto insurance.

To assist you recognize just how rates differ, Money, Geek damaged down The golden state's ordinary price according to the factors most influencing it - vans. Average Expense of Car Insurance in The Golden State: Summary, There are lots of elements influencing automobile insurance rates in The golden state. Age is the element that impacts premium rates one of the most, adhered to by exactly how much coverage you acquire - credit.

, putting the Home page state in 10th location. Both add to the high chance of vehicle drivers submitting cases. cheapest car. A 16-year-old would be better off being added to their moms and dads' automobile insurance plan than purchasing one on their very own (auto insurance).

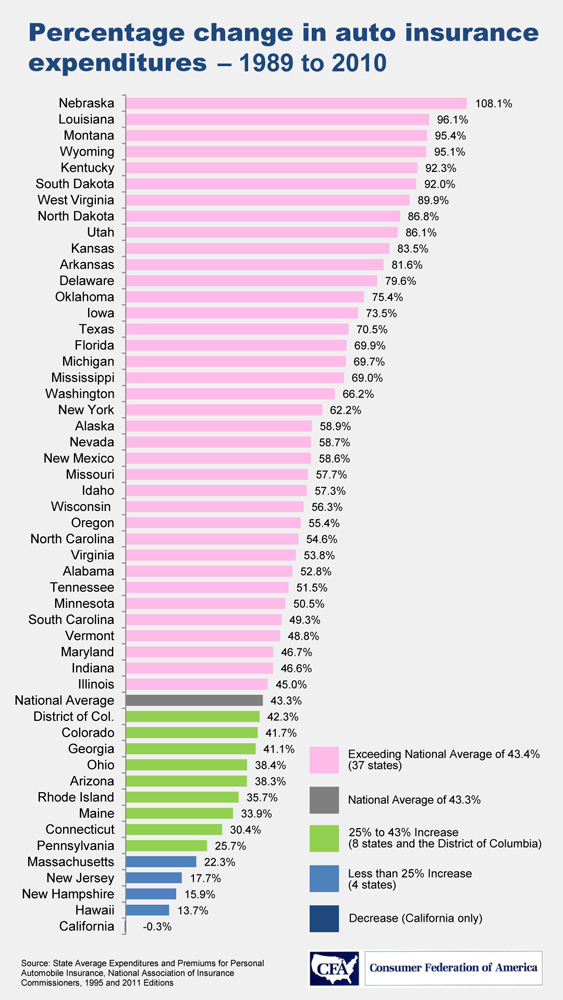

How Much Is Car Insurance in Your City? The price of auto insurance coverage differs from state to state.

4% reduced than the ordinary expense of vehicle insurance in The golden state. 8% higher than the state average and also even more than double Santa Maria's rate.

low cost auto insurance cheaper cars

low cost auto insurance cheaper cars

Right here are the ones regularly asked the responses may assist you recognize exactly how much auto insurance expenses in The golden state - credit score. Increase ALLWhat is the ordinary price of auto insurance in The golden state?

It is for a 40-year-old vehicle driver with a tidy driving document. We also made use of information from the adhering to resources to complete the evaluation:2019 information from the Federal Highway Management to calculate freeway website traffic density2019 information from the Insurance coverage Study Council to establish information on uninsured vehicle drivers, The current data from the U (perks).S - laws.

What Does Faq - California Low Cost Auto Insurance Mean?

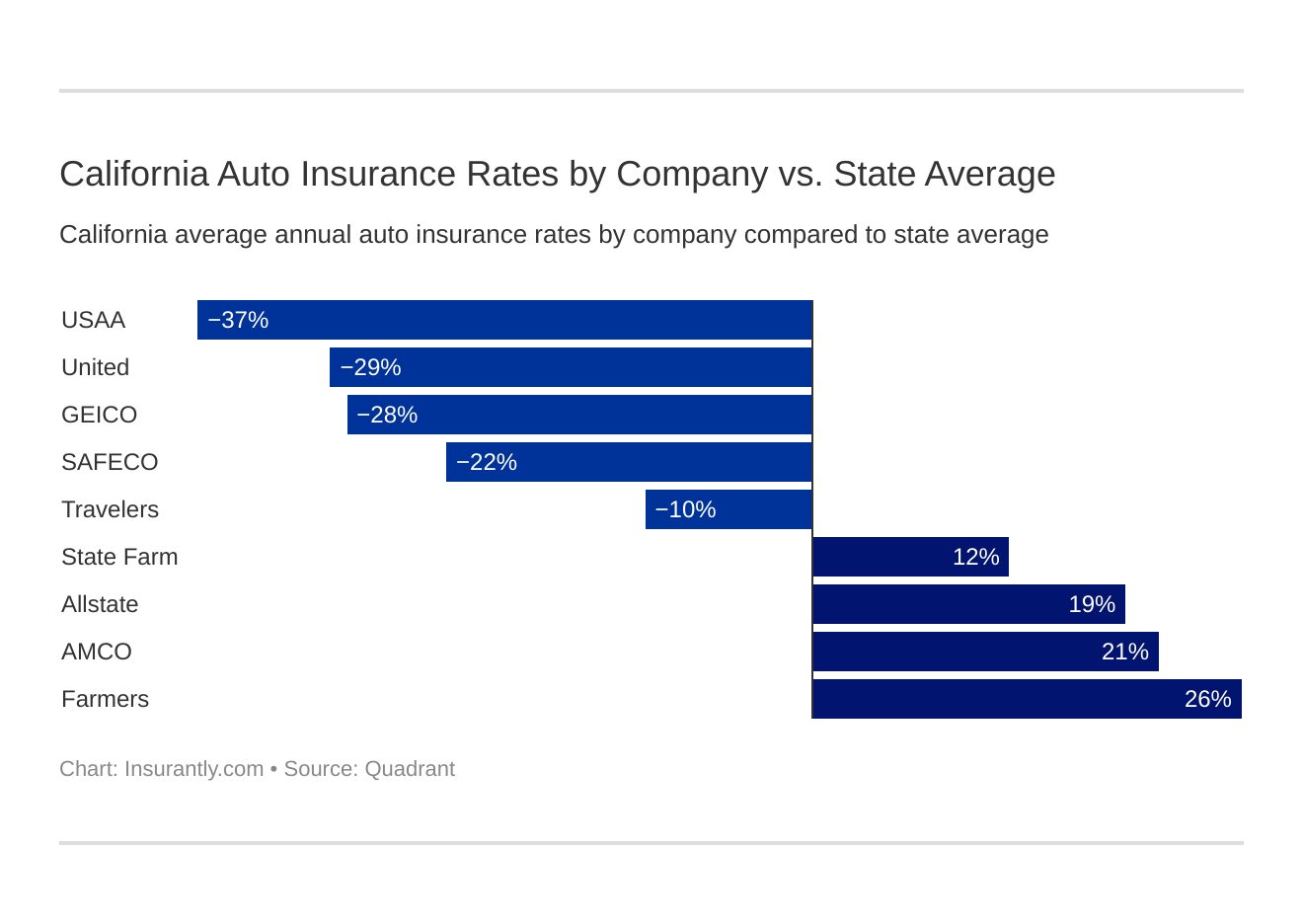

Drivers in the Golden State pay a standard of $2,065 each year, or concerning $172 monthly, for full insurance coverage vehicle insurance policy, according to Bankrate's 2021 study of priced quote annual costs. To identify the average cost of cars and truck insurance policy in California, our insurance coverage editorial team assessed typical prices offered by Quadrant Info Solutions for city areas throughout the state.

Motorists in Los Angeles pay the most without a doubt for automobile insurance policy, according to our research study, with a typical price for complete protection insurance of $2,838 annually, 37% over the state average - cheaper car insurance. California moms and dads including a 16-year-old motorist to their full coverage car insurance coverage can expect an ordinary annual rise of $3,744 annually.